Our Services

Membership

hello world!

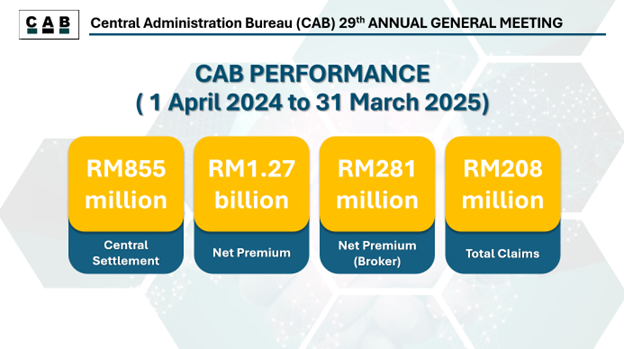

On August 23rd, 2025 , the Annual General Meeting for the CAB stakeholders has been held at the AICB, Center of Excellence ACE, Kuala Lumpur. The objective of the AGM is to provide the annual report of production through CAB for the year 2025.

The agendas of the meeting are as below:

Report of the Supervisory Board

Here’s the performance of CABFAC

As for CABCO’s performance in FYE2025

Report of the Bureau Manager

The Bureau Manager reported that as of March 31st, 2025, the total transaction volume decreased by 3% compared to the previous financial year. However, the total net premium processed through CAB saw a 6% increase compared to FYE2024. Broker business contributed approximately 64% of the total net premium, amounting to RM 437 million, which represents a 5% decrease from RM 297 million in FYE2024 to RM 281 million in FYE2025.

In FYE2025, CAB significantly enhanced its reporting capabilities, incorporating valuable feedback from users and administrators to deliver improved functionality and user experience. The CAB Interface Project was successfully completed, with Lonpac Insurance Berhad achieving a milestone by processing 61 cases seamlessly across both systems. Several other member companies have commenced implementation and are in the process of finalizing key details. Looking ahead, CAB anticipates broader development, with more members expected to go onboard in the upcoming financial years

Audited accounts for the year ended 31st March 2025

On 5th June 2025, the Supervisory Board adopted the audited accounts of the Central Administration Bureau for the period ended 31st March 2025 together with the Auditors’ Report thereon.

Contribution and Charges for CAB Services

As per Article 8.6 (vii) of the Collective Agreement, the Supervisory Board at its meeting held on 26th March 2025 had considered the income of the CAB and budget for the forthcoming year.

| FYE 2025 | CABFAC (RM) | CABCO(RM) | TOTAL (RM) |

| Total Operation Income | 2,106,177 | 1,564,297 | 3,670,474 |

| Total Operation Expenses | (1,667,267) | (1,185,936) | (2,853,203) |

| Surplus from Operation | 438,910 | 378,361 | 817,271 |

| Tax on Interest Income | (84,367) | (81,774) | (166,141) |

| Net Surplus | 354,543 | 296,587 | 651,130 |

| FINANCIAL YEAR ENDED (FYE) | CABFAC (RM) | CABCO (RM) | TOTAL (RM) |

| 2012 | - | (195,562) | (195,562) |

| 2013 | 163,637 | 9,589 | 173,226 |

| 2014 | 429,966 | 707,569 | 1,137,535 |

| 2015 | 398,156 | 247,660 | 645,816 |

| 2016 | 157,445 | 261,340 | 418,785 |

| 2017 | 411,889 | 413,343 | 825,232 |

| 2018 | 323,051 | 405,912 | 728,963 |

| 2019 | 160,052 | 295,299 | 455,351 |

| 2020 | (533,092) | 225,050 | (308,042) |

| 2021 | (284,041)) | 347,581 | 63,540 |

| 2022 | 41,623 | 229,580 | 271,203 |

| 2023 | 313,390 | 416,188 | 729,578 |

| 2024 | 243,513 | 373,829 | 617,342 |

| 2025 | 178,718 | 121,762 | 301,480 |

| Total amount | 2,005,307 | 3,959,140 | 5,864,447 |

| Transaction Charges @ RM1.00 per transaction |

| Transaction levy @ 0.30% on net accepted premium but for CABCO with ceiling of RM5,000 whichever is lower |

| Annual Fee @ RM7,195 per member |

| Annual Fee @ RM1,500 per broker |

| Monthly fee of RM50 for brokers |

| BUDGET FYE2025 | CABFAC (RM) | CABCO (RM) | TOTAL (RM) |

| Total operating income* | 1,976,460 | 1,610,000 | 3,586,460 |

| Total operating expenses | (1,585,170) | (1,341,950) | (2,927,120) |

| Loss from operation | 391.290 | 268,050 | 659,340 |

| Tax on interest income | (82,900) | (90,000) | (172,900) |

| Net surplus | 308,390 | 178,050 | 486,440 |

*Including transaction charges, annual fee and interest income

The report and proposal were accepted with no rejection by the stakeholders.

*Including transaction charges, annual fee and interest income

The report and proposal were accepted with no rejection by the stakeholders.

The members of Supervisory Board for tenure 2023/2024 as below:

| No. | Company | CEO Name | Role |

| 1 | Pacific & Orient Insurance Co. Bhd. | Mr. Noor Muzir Mohamed Kassim | CAB Chairman |

| 2 | AIG Malaysia Insurance Berhad | Mr. Antony Lee | PIAM Representative |

| 3 | Malaysian Reinsurance Berhad | Mr. Ahmad Noor Azhari Abdul Manaf | Permanent Member |

| 4 | Allianz General Insurance Co. (M) Berhad | Mr. Sean Wang Wee Keong | Board Member |

| 5 | Etiqa General Takaful Berhad | Mr. Shahrul Azuan Mohamed | Board Member |

| 6 | Kuwait Reinsurance Company | Mr. Abdallah Badaoui | Board Member |

| 7 | Lonpac Insurance Berhad | Mr. Looi Kong Meng | Board Member |

Following the CAB 29th Annual General Meeting, Mr. Shahrul Azuan Mohamed has completed his tenure as Chairman. His leadership played a pivotal role in driving CAB’s growth and success, and the organization extends its sincere appreciation for his dedication and contributions throughout his term.

The Chairman informed that there were vacancies on the CAB Supervisory Board by virtue of the following:

End of 2-year Tenure

| No. | Company | CEO Name |

| 1 | Allianz General Insurance Co. (M) Berhad | Mr. Sean Wang Wee Keong |

| 2 | Kuwait Reinsurance Company | Mr. Abdallah Badaoui |

In accordance with Article 8.1(i) and (iv) of the Collective Agreement, nomination forms were circulated to all participants on 11 July 2025 for the seats on the Supervisory Board. The Supervisory Board has received the following nominations:

| No. | Company | CEO Name |

| 1 | Allianz General Insurance Co. (M) Berhad | Mr. Sean Wang Wee Keong |

| 2 | Kuwait Reinsurance Company | Mr. Abdallah Badaoui |

| 3 | Syarikat Takaful Malaysia Am Berhad | Mr. Mohamed Sabri Ramli |

The Article 8.1(i) of the Collective Agreement stipulates that the number of SB members shall not be more than seven (7), which includes the Permanent Member as representative of the Administration Manager.

Chairman highlighted that as the number of nominations did not exceed the number of vacancies, election for the new Supervisory Board members was therefore not required.

Re-appoint auditor and authorize the Supervisory Board to fix their Remuneration

The Chairman informed the meeting that as it was essential for CAB to appoint an external auditor for the ensuing year, it was then necessary for its members to authorize the Supervisory Board to agree on the scope of the audit and to fix the auditors’ remuneration accordingly. The retiring auditor, Messrs Ernst & Young PLT had indicated their willingness to be reappointed.

The Chairman invited a member to propose that Messrs Ernst & Young PLT be appointed as external auditor for the CAB for the ensuing year and for the Supervisory Board to agree on the scope of the audit and to fix their remuneration

During the CAB 29th Annual General Meeting, a representative of Chubb Insurance Malaysia Berhad proposed the appointment of Messrs Ernst & Young PLT as CAB’s external auditor for the upcoming financial year. The proposal, seconded by the representative of Zurich General Takaful Malaysia Berhad, received unanimous approval from the members. It was resolved that Messrs Ernst & Young PLT be appointed as the external auditor for the financial year ending 2026, with the Supervisory Board authorized to determine the audit scope and fix the auditor’s remuneration

The Chairman requested members to indicate their agreement to the proposal by a show of hands. It was noted that the members unanimously agreed to the proposal.

Resolved that Messrs Ernst & Young PLT be appointed as the external auditor for the Central Administration Bureau for the FYE 2026 and the Supervisory Board be authorized to agree on the scope of the audit and to fix the remuneration of the auditor

As all agendas have been discussed, the meeting opened for Q&A sessions to all participants

The meeting then concludes at 3.45 evening.