Our Services

Membership

hello world!

On August 23rd, 2024 , the Annual General Meeting for the CAB stakeholders has been held at the AICB, Center of Excellence ACE, Kuala Lumpur. The objective of the AGM is to provide the annual report of production through CAB for the year 2023.

The agendas of the meeting are as below:

Report of the Supervisory Board

Here’s the performance of CABFAC

As for CABCO’s performance in FYE2024

Report of the Bureau Manager

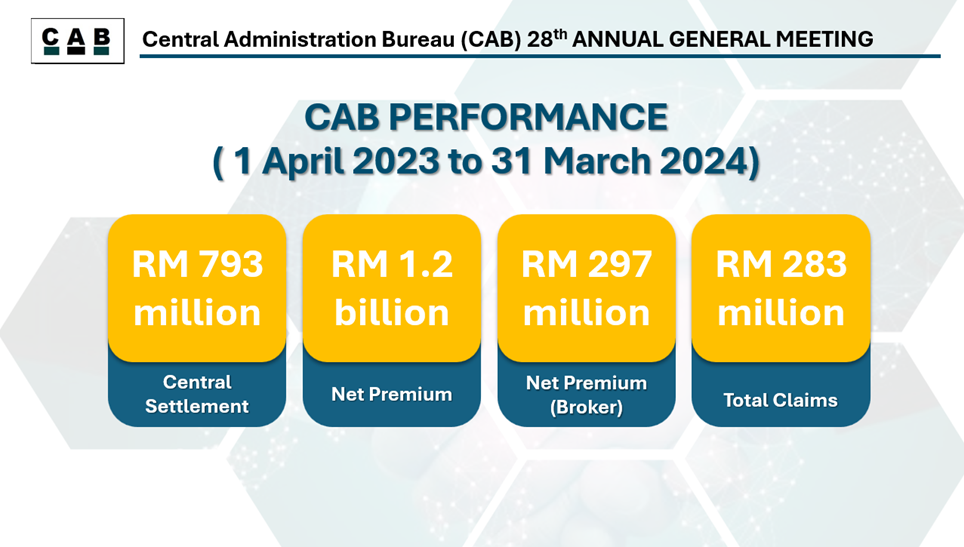

The Bureau Manager reported that as of March 31st, 2024, the total transaction volume increased by 15% compared to the previous financial year. However, the total net premium processed through CAB saw a 4% decrease compared to FYE2023. Broker business contributed approximately 65% of the total net premium, amounting to RM 457 million, which represents a 1.57% decrease from RM 302 million in FYE2023 to RM 297 million in FYE2024.

In FYE2024, CAB enhanced its reporting features based on feedback from users and administrators. Additionally, the CAB Interface project was successfully completed, with three companies which are Etiqa General Insurance Berhad, Etiqa General Takaful Berhad, and Allianz General Insurance Company (Malaysia) Berhad going live in February and March 2024, respectively.

On the CAB system, we would highlight that CAB Interface project which involved Etiqa General Insurance Berhad and Etiqa General Takaful Berhad successfully went live in February 2024 with the upload function for the Preliminary Claim Advice module. Additionally, Allianz General Insurance Company (Malaysia) Berhad completed their implementation in March 2024, covering both the Preliminary Claims Advice and Claim Settlement modules.

Audited accounts for the year ended 31st March 2024

On 29th May 2024, the Supervisory Board adopted the audited accounts of the Central Administration Bureau for the period ended 31st March 2024 together with the Auditors’ Report thereon.

Contribution and Charges for CAB Services

As per Article 8.6 (vii) of the Collective Agreement, the Supervisory Board at its meeting held on 26th March 2024 had considered the income of the CAB and budget for the forthcoming year.

| FYE 2024 | CABFAC (RM) | CABCO(RM) | TOTAL (RM) |

| Total Operation Income | 1,758,789 | 1,495,659 | 3,254,448 |

| Total Operation Expenses | (1,351,117) | (987,462) | (2,338,579) |

| Surplus from Operation | 407,672 | 508,197 | 915,869 |

| Tax on Interest Income | (96,879) | (95,268) | (192,147) |

| Net Surplus | 310,793 | 412,929 | 723,722 |

| FINANCIAL YEAR ENDED (FYE) | CABFAC (RM) | CABCO (RM) | TOTAL (RM) |

| 2012 | - | (195,562) | (195,562) |

| 2013 | 163,637 | 9,589 | 173,226 |

| 2014 | 429,966 | 707,569 | 1,137,535 |

| 2015 | 398,156 | 247,660 | 645,816 |

| 2016 | 157,445 | 261,340 | 418,785 |

| 2017 | 411,889 | 413,343 | 825,232 |

| 2018 | 323,051 | 405,912 | 728,963 |

| 2019 | 160,052 | 295,299 | 455,351 |

| 2020 | (533,092) | 225,050 | (308,042) |

| 2021 | (284,041)) | 347,581 | 63,540 |

| 2022 | 41,623 | 229,580 | 271,203 |

| 2023 | 313,390 | 416,188 | 729,578 |

| 2024 | 243,513 | 373,829 | 617,342 |

| Total amount | 1,825,589 | 3,737,378 | 5,562,967 |

| Transaction Charges @ RM1.00 per transaction |

| Transaction levy @ 0.30% on net accepted premium but for CABCO with ceiling of RM5,000 whichever is lower |

| Annual Fee @ RM7,195 per member |

| Annual Fee @ RM1,500 per broker |

| Monthly fee of RM50 for brokers |

| BUDGET FYE2025 | CABFAC (RM) | CABCO (RM) | TOTAL (RM) |

| Total operating income* | 2,061,895 | 1,884,800 | 3,946,695 |

| Total operating expenses | (1,446,960) | (1,332,480) | (2,779,440) |

| Loss from operation | 614,935 | 552,320 | 1,167,255 |

| Tax on interest income | (95,300) | (116,700) | (212,000) |

| Net surplus | 519,635 | 435,620 | 955,255 |

*Including transaction charges, annual fee and interest income

The report and proposal were accepted with no rejection by the stakeholders.

*Including transaction charges, annual fee and interest income

The report and proposal were accepted with no rejection by the stakeholders.

The members of Supervisory Board for tenure 2023/2024 as below:

| No. | Company | CEO Name | Role |

| 1 | Pacific & Orient Insurance Co. Bhd. | Mr. Noor Muzir Mohamed Kassim | CAB Chairman |

| 2 | AIG Malaysia Insurance Berhad | Mr. Antony Lee | PIAM Representative |

| 3 | Malaysian Reinsurance Berhad | Mr. Ahmad Noor Azhari Abdul Manaf | Permanent Member |

| 4 | Allianz General Insurance Co. (M) Berhad | Mr. Sean Wang Wee Keong | Board Member |

| 5 | Etiqa General Takaful Berhad | Mr. Shahrul Azuan Mohamed | Board Member |

| 6 | Kuwait Reinsurance Company | Mr. Abdallah Badaoui | Board Member |

| 7 | Lonpac Insurance Berhad | Mr. Looi Kong Meng | Board Member |

In accordance with the Collective Agreement, nomination forms were circulated to all participants on 23rd August 2024 for the seats on the Supervisory Board. As the number of nominations has not exceeded the number of vacancies, election of the new Supervisory Board members is therefore not required.

As all agendas has been discussed, the meeting opened for Q&A session to all participants

The meeting then concludes at 12.00 noon